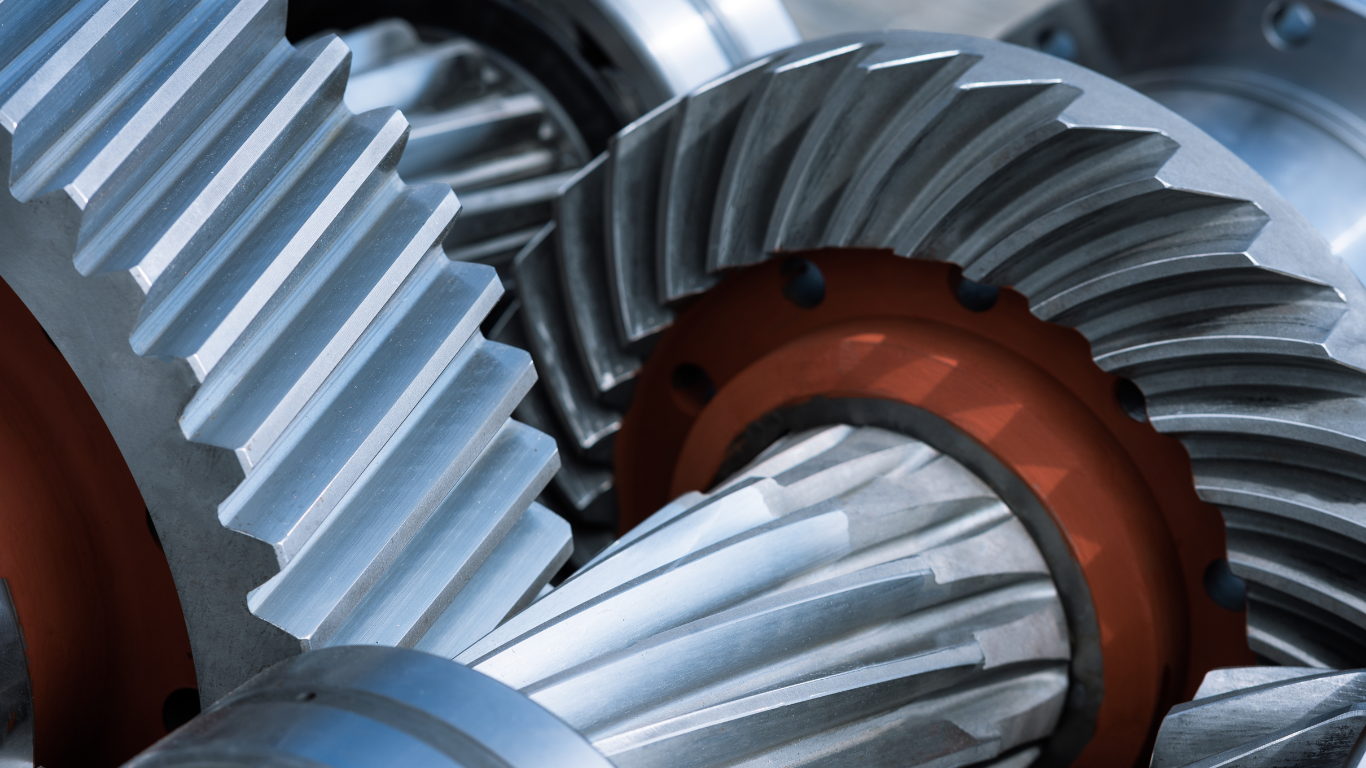

Fuel Your Manufacturing Growth with the SBA 504 Loan Program

Looking to expand your manufacturing business, purchase equipment, or build new facilities? Metro Area Development Corporation (MADCO) can help you secure affordable, long-term financing through the SBA 504 Loan Program. With the new Made in America Manufacturing Initiative, announced by SBA Administrator Loeffler, U.S. manufacturers now have greater access to SBA-backed funding. This initiative streamlines the process, making it easier for small businesses like yours to grow, create jobs, and drive the local economy forward. Let MADCO guide you through the financing options that power your success.

The SBA 504 loan program provides small businesses with long-term, fixed-rate financing for major fixed assets that promote business growth and job creation. These loans feature:

• Low 10% down payment (vs 20-30% conventional)

• Below-market fixed interest rates (locked 10-25 years)

• Loans up to $5.5 million ($6.5M for manufacturing) • 50/40/10 financing structure:

- 50% from bank (1st mortgage)

- 40% from CDC/SBA (2nd mortgage)

- 10% from borrower

Eligible uses include purchasing land/buildings, heavy equipment, or funding renovations. Ideal for manufacturers, medical practices, and other businesses needing stable financing for growth.

TURNING SMALL BUSINESS DREAMS INTO REALITY

Welcome to MADCO, the Metro Area Development Corporation, where small business dreams become reality. Our mission is to support the growth and expansion of small businesses in Oklahoma by providing affordable financing options. As a non-profit Certified Development Company (CDC), we partner with the U.S. Small Business Administration (SBA) to offer advantageous SBA 504 loans. Let's embark on a journey to grow your business and create new private-sector jobs together. Contact us today to learn more!

ACHIEVE GOALS WITH SBA 504 LOAN SOLUTIONS

Thank you for inquiring about the SBA 504 Debenture Loan to help meet your business needs. At MADCO, we are committed to helping you achieve your goals in acquiring or refinancing your business. The SBA 504 Loan Program offers an excellent opportunity for small businesses to secure long-term, fixed-rate financing for major fixed assets like real estate and equipment, significantly enhancing your business’s growth and stability.

OFFERING LOANS TAILORED TO MEET YOUR BUSINESS NEEDS

Securing a loan with MADCO is straightforward and efficient. We work with you every step of the way, from initial application to final approval, ensuring a smooth process. Our team of experts is dedicated to helping you navigate the complexities of business financing, making it easier for you to focus on what matters most—running your business. Our SBA 504 loans are tailored to meet your business needs, providing a reliable financial solution for growth. Are you ready to take the next step? Reach out to us now!

Long-term, fixed-rate financing.

Lowest down payment plans.

Support for real estate & equipment buys.

Partnered with SBA for trusted service.

With MADCO, you’re not just getting a loan; you’re gaining a partner committed to your success. We believe in the potential of small businesses to drive economic growth and innovation. Our goal is to provide the financial tools and support you need to achieve your business ambitions. Let’s build a brighter future together. If your business meets these criteria, you’re on your way to benefiting from our exceptional loan programs:

- Your business must be for-profit.

- The net worth must be under $15 million.

- The average net income must be under $5 million after taxes for the past 2 years.

504 Debenture loans through the Sba

MADCO plays a key role in helping small businesses secure financing for major investments, such as real estate and equipment. The loans are structured with contributions from both the organization and a bank, allowing for a low down payment. With fixed interest rates and extended repayment terms, these loans enable businesses to manage their cash flow effectively while pursuing growth. Additionally, they focus on job creation, reinforcing their role in fostering economic development in communities across the nation.

EXPLORE THE ELIGIBLE USES OF OUR SBA 504 LOANS

Investing in your business’s future has never been easier with MADCO’s competitive rates and terms. Our SBA 504 loans offer low, fixed interest rates and extended repayment terms, making it possible for you to plan your finances with confidence. Whether you're expanding operations or upgrading equipment, our loan options are designed to fit your needs. Start planning your next big move today!

Loan Application Processes Made Simple

Join the many successful businesses that have benefited from MADCO’s financing solutions. Our commitment to fostering small business growth has had a significant impact on Oklahoma’s economy. We guide you through each step, ensuring clarity and transparency throughout the process. Ready to begin? Apply now and watch your business grow!

Submit your application.

Get preliminary approval.

Complete required documentation.

Finalize loan agreement.

JOIN OUR THRIVING SMALL BUSINESS COMMUNITY

At MADCO, we provide long-term, fixed-rate financing through the SBA 504 Loan Program to support small business growth and stability. Our services include loans for real estate, equipment purchases, and site improvements. With competitive rates and a seamless application process, we are dedicated to your success. We invite you to be part of this thriving community. Explore our website for more information, success stories, and detailed loan options. Your business deserves the best—choose MADCO today!